It can be very confusing to understand the calculate sales tax in the United States especially when you have the overall price and you need to determine the value of the discounted price of the product without the taxes. Note: It is a lot more useful to know how to compute sales tax of total whether having a restaurant bill to check, checking a purchase made on the internet, reviewing an invoice or even comparing the prices across the states.

This guide is written in the most simple and understandable manner. You will know about reverse tax math, how to check the bills properly, how a Reverse calculator will simplify the whole process and make the process stress-free. No complicated formulas. No advanced math. Just simple, human understandable explanations that can be applied in daily life.

The importance of this guide to (USA) Shoppers, Business owners and online buyers.

Day after another millions of individuals in the USA make sales tax payments without a clear understanding of the percentage of their bill of the service tax amount in fact and the ultimate cost of the product. In the majority of receipts, the actual price is not stated, but rather the accumulated price.

This causes confusion like:

Was the store charged the appropriate tax?

How do I get the original price over and above this amount?

“Why does tax appear to be different in a different state?

What is my after tax actual price?

Reverse tax calculation is important because of that.

And that is the reason why such tools as a sales tax calculator are becoming highly popular, easy, quick, and precise.

It is a guide that is meant to simplify everything.

What to Expect in this 4000-word Guide.

What sales tax is ?

The USA sales tax (difference in states) work.

Performing calculations of tax in the normal way.

Calculating backwards sales tax.

Simple method of explanation with respect to reverse tax formula.

Detailed examples of U.S. real life (restaurant, shopping, ecommerce).

Detailed step by step guidelines.

Comparison tables

Tools, tips, and shortcuts

Advantages and disadvantages of making use of a Reverse calculator.

calculate sales tax is a percentage levied to the price of goods or services.

In the USA:

- States impose their individual rate of sales tax.

- Additional local tax is imposed on some cities and counties.

- Sales tax is paid by the buyer

- The government gets it through the seller.

Example (Very Simple):

Suppose that something costs you 100 dollars and that the tax rate of your state is 7 percent:

Tax: $7

Final Total: $107

What however should you do even when you do not know the original cost but only the final amount?

In that case, there comes reverse tax calculation.

The reason why people require reverse sales tax calculation.

Reverse calculate sales tax is calculated by people due to various reasons:

- Everyday Shopping

- Grocery stores

- Clothing stores

- Large store chains (Walmart / Target).

- Electronics

- Restaurants

- In order to know pre-tax food cost.

- Computation of tips becomes less complex.

- Online Shopping

- Amazon

- eBay

- Shopify stores

- Business & Freelancers

- Invoice checking

- Profit calculation

- Expense breakdown

- Budgeting

- Monthly budget planning

- Interstate price comparison.

- Regardless of who you are – reverse tax formula makes life simpler.

Simple Breakdown of Types of calculate sales tax in the USA.

Type Explanation Example

- State Sales Tax Imposed by state government 7.25% in California.

- Local Sales Tax Added by counties or cities NYC added tax on the top.

- Combined Sales Tax State + local tax combined 8.875, 9.5, etc.

- Use Tax Apply to the purchase of other state Online orders.

Sales tax is quite different that a certain product will have totally different amounts between different states.

The Forward Calculation of how normal calculate sales tax works.

Formula:

Final Total = Price x (1 + Tax Rate)

Example:

Price: $100

Tax rate: 6%

Total = 100 x 1.06 = $106

But what if you only know the $106?

Then there you have to have the opposite.

When to calculate sales tax backwards

You require an inverted formula when it comes to determining how much the original price was based on a total price that you know. The approach eliminates the level of sales tax and depicts the real pre tax price. This is a technique that is adopted by many shoppers in the USA where the receiepts do not provide breakdowns of items.

Reverse Formula (Very Easy)

Original Price = Total Amount/ (1 + Tax rate).

Example

Total: $107.25

Tax rate: 7.25% (0.0725)

Calculation:

107.25 / 1.0725 = $100

Why This Matters

- Helps check correct billing

- Useful for budgeting

- The high tax states avoid confusion.

- Helps business owners estimate revenues correctly.

Instructional (Easy to Learn)

Calculate the aggregate of the bill.

Divide tax rate by an express fraction.

Add 1 to the decimal

Divide total by that number

Result = original price

Tax = total – original price

Simple, fast, and 100% accurate.

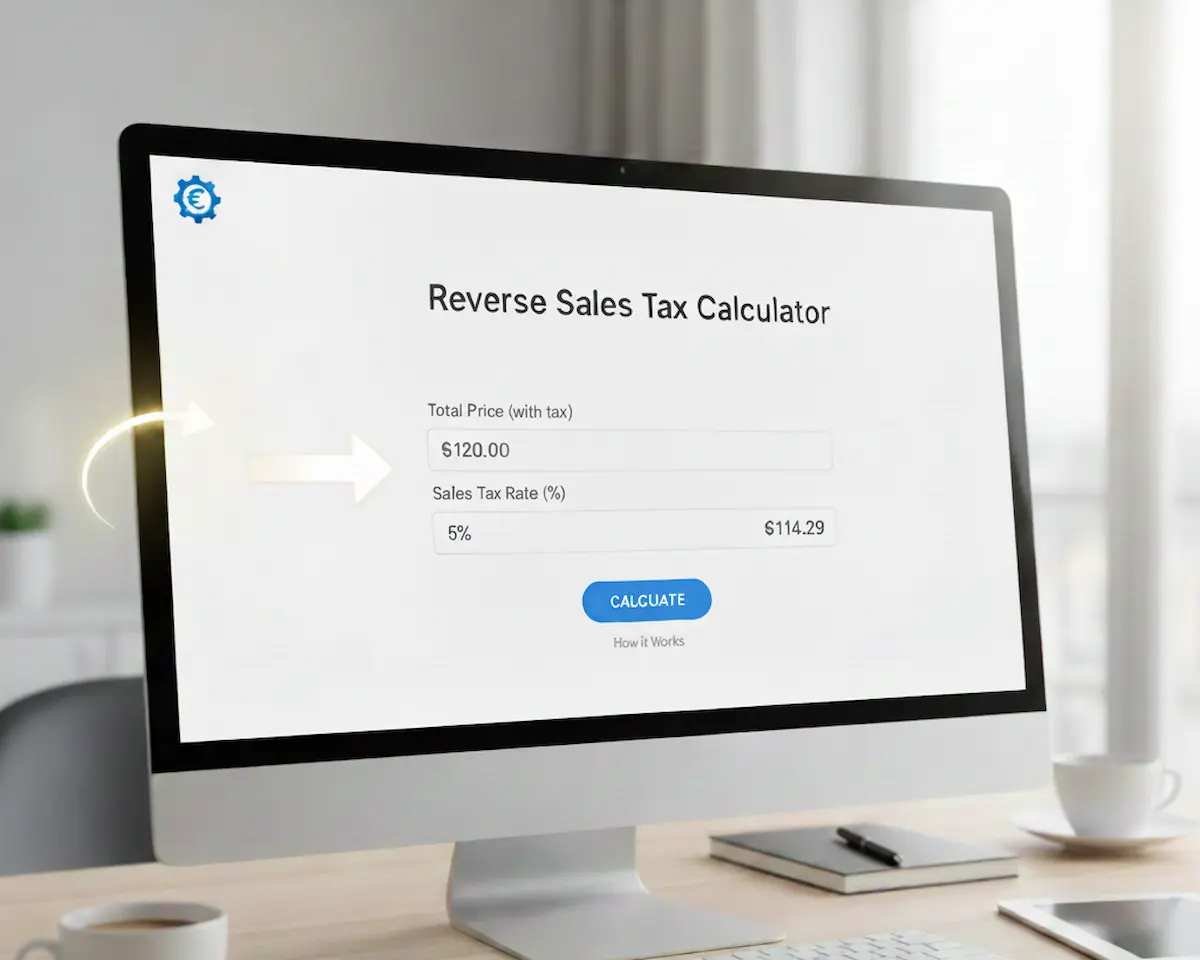

Knowledge (Human Explanation) of Reverse Calculator.

A reverse calculator enters in the total amount then calculate sales tax off and displays:

Original price (before tax)

- Tax amount

- Effective tax percentage

- This is more convenient than hand-calculation and can be used on:

- Stores

- Restaurants

- Services

- Online shopping

- Billing

- Invoices

- It is also an essential shortcut among the USA consumers.

Specimen of Playing with Reverse Sales Tax in USA.

Example 1 California Shopping.

Total: $214.50

Tax Rate: 7.25%

Pre-tax = 214.50 / 1.0725 = $200

Tax: $14.50

Example 2: New York Restaurant

Total: $54.36

Tax Rate: 8.875%

Pre-tax = 54.36 / 1.08875 = $49.93

Example 3: Texas Store

Total: $107.00

Tax Rate: 6.25%

Pre-tax = 107 / 1.0625 = $100.71

Comparison of Taxation on Property, Payroll, and Earnings across States (USA).

State Average Tax Pre-Tax Price

Example Pre-Tax Price

calculated by the following formulations:

California 7.25% $107.25 $100

Texas 6.25% $106.25 $100

Florida 6% $106 $100

New York 8.875% $108.88 $100

The importance of Calculating Sales Tax.

Zero mistakes

Faster than manual math

Works with any state tax rate

Great for online shopping

Helps track expenses

Ideal for small businesses

A sales tool calculator of taxes is time-saving and less confusing.

Detailed Step-by-step (Reverse Calculation)

- Look at the total you paid

- Visi.jurisdictional sales tax rate.

- Divide tax rate into a decimal.

- Add 1 to the decimal

- Division by the number gives a total.

- You are now in possession of the starting price.

- Total less original price of product less tax amount.

- Common Mistakes People Make

- Using wrong tax rate

- Omission to change the percent to decimal.

- Substitution of state tax with county tax.

- Not including tax (sometimes, it is not).

- With the forward backward formula.

- Advantages and disadvantages of a Reverse Calculator.

Pros

Quickest method of obtaining pre-tax price.

Accurate results

No math skills needed

Saves on time of budget planning.

Cons

Requires correct tax rate

Unhelpful in tax-free states.

Certain bills are full of additional charges.

Real Life USA Case Studies

Case Study 1: Online Shopper

Sarah purchased electronics at an online company. It was a total of $642.30 and she was interested in knowing the actual price of the item.

By reversing calculation she was able to discover that the starting price was 599.

Case Study 2: Restaurant Bill

Mark was visiting a restaurant in NYC. His bill was recorded as having a total of 108.88 but not food only.

A reverse math indicated there was a price of 100 on food.

| Forward Calculation | Reverse Calculation |

| Forward Calculation Price x (1 + tax) | When you know the price. |

| Reverse Calculation Total / (1+tax) | Equal to the total when you know the total. |

FAQ (Your Specific Questions Included).

Calculation The calculation of backwards calculation of sales tax using total?

Use:Original Price = Total/(1+ Tax rate)

The calculation of tax on a sum of money?

Tax = Pre-Tax Price x Tax Rate

What is your calculation of reverse GST on a total?

Same method:Total / (1 + GST%)

How to calculate 20% backwards?

Divide by 1.20

Example:

240 / 1.20 = 200

Conclusion

One of the most valuable shortcuts to shoppers in the USA, business owners and online buyers include reverse tax calculation. You can go straight to the real price and tax and total price by a reverse method or Reverse calculator when you have just the total price. It is easy, quick, and suitable to daily use.